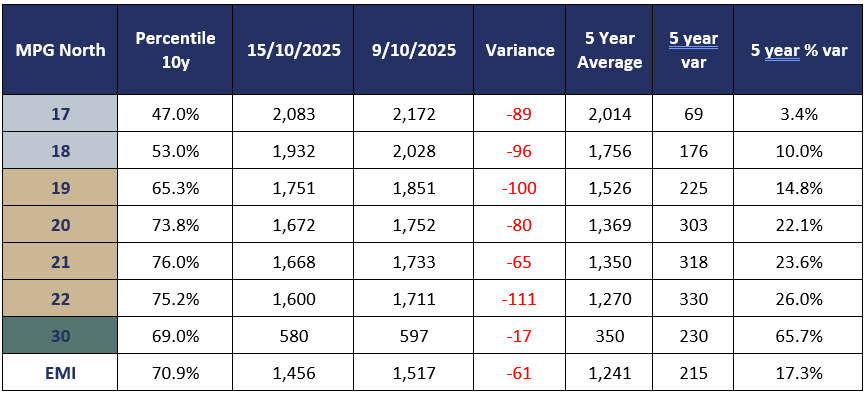

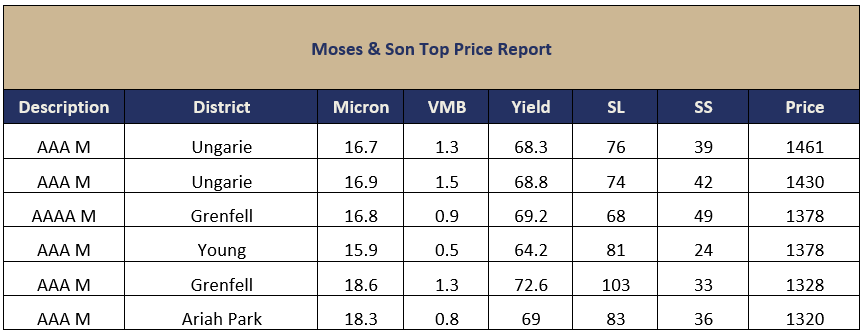

Merino fleece experienced wild MPG movements across selling centres. While premiums for the 1618.5 µ categories were evaporating, this could partly be explained by differences in selection, storage location, or a realignment of price disparities between centres from previous weeks.

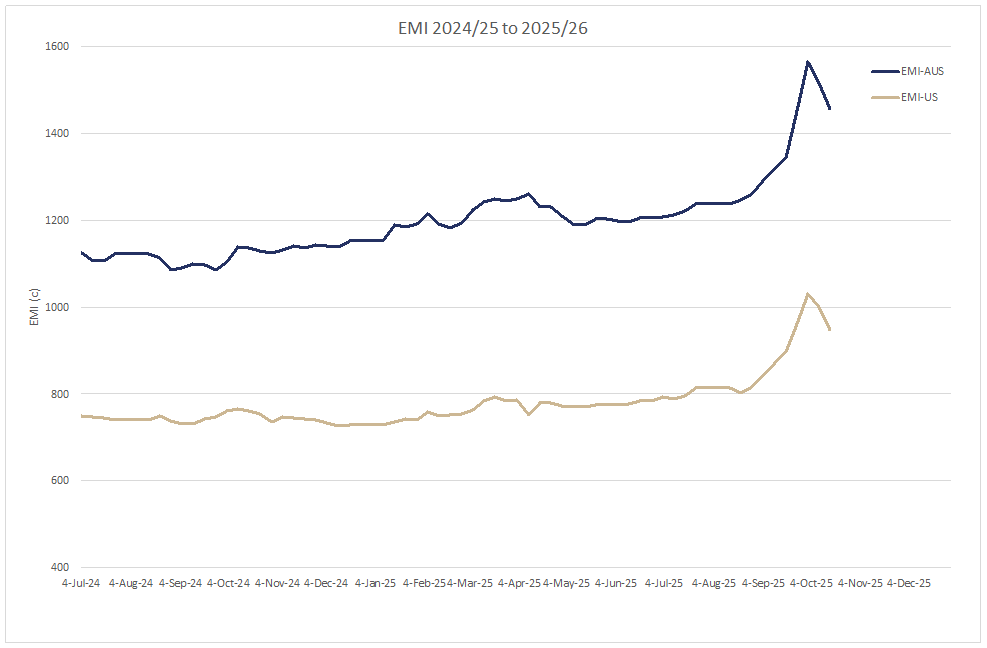

Merino fleece experienced wild MPG movements across selling centres. While premiums for the 1618.5 µ categories were evaporating, this could partly be explained by differences in selection, storage location, or a realignment of price disparities between centres from previous weeks.The AWEX EMI closed at 1456c, down 61c (-4%) at auction sales in Australia last week. Tuesday’s EMI was 43c cheaper, with falls between 22c and 66c recorded in the MPGs, the finer end being least affected.

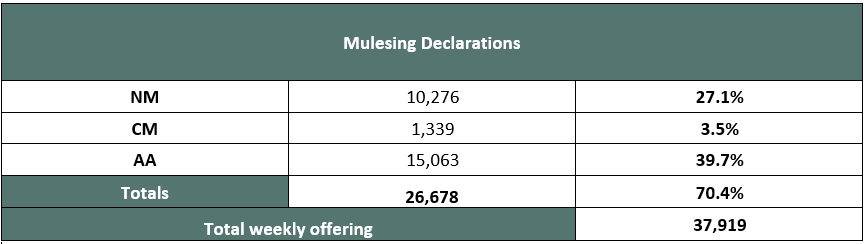

On Wednesday, MPG movements were more erratic, resulting in a further 18c fall in the EMI. At this time last week, the initial weekly offering was around 41,000 bales, including 2,569 bales ex-New Zealand.

After passed-in and withdrawn lots, just 28,589 bales were eventually sold — representing a clearance of only 70% of the initial offering. The collective retracement in the EMI over the past two weeks totals 109c (-7%), which is slightly less than half of the previous fortnight’s rise of 221c, the fifth-largest weekly rise since AWEX records began. The AUD/USD exchange rate fell 0.85c to close at 65.15c, while the EMI in USD terms fell 53c.

The significant declines in Merino fleece and skirtings caught most sellers off guard, and the volatility reflects the delicate emotional balance being tested from the farm gate to the garment maker.

Merino skirtings experienced similar falls to their fleece counterparts, with the largest downward movements recorded on Tuesday. Wednesday’s prices continued to decline, though at a slower rate. Well-prepared skirtings with 3% VM or less remained in good demand, while heavier VM lines attracted larger discounts and were more difficult to sell.

Merino cardings varied between selling centres, with Sydney’s MC holding firm, while Melbourne and Fremantle fell by 20c and 29c respectively.

Crossbreds

Crossbred combing types were 20–35c cheaper on Tuesday and continued to fall a further 15–25c on Wednesday.

Early market intelligence remains cautious regarding next week’s prices. My sources have expressed concern that Superfine types (16–18.5 µ) may face further price pressure, while 19.0 µ and broader types could begin to establish a new trading level in the coming weeks. ~ Marty Moses.

Market Commentary

It’s always difficult to accept a lower price than the previous week; however, current levels are still well above those of a month ago and represent profitable returns for producers. It has become evident that offerings around 40,000 bales are now seen as a “market killer” by Chinese processors. Last week’s 48c fall in the EMI likely contributed to caution among sellers, resulting in this week’s reduced offering of just under 38,000 bales, of which 85.4% cleared to the trade.

While supply remains the dominant factor in market outlook, a rise in retail demand will be essential before any sustainable increase in wool prices can be expected. Year-to-date auction offerings indicate a 2.8% reduction, while AWTA data shows a 16% reduction in bales tested compared to last season. This suggests that wool coming out of shearing sheds and grower-held stocks in brokers’ stores is making up the difference.

The combination of reduced supply and selective buying indicates the market is seeking a new level of equilibrium. Keep an eye out for the guide to voting at the AWI AGM. This will help guide you through the process and assist in extending preferences to those who may still be undecided.